|

|

市場調査レポート

商品コード

1858525

原薬(API)の世界市場:タイプ別、力価別、合成タイプ別、薬剤タイプ別、治療用途別、エンドユーザー別、地域別 - 2030年までの予測Active Pharmaceutical Ingredients (API) Market by type (Innovative, Generic), Synthesis (synthetic, biotech), Potency (HPAPI), Product (mAbs, hormones), Drug (OTC, Rx), Application (Diabetes, Oncology), Competitive landscape - Global forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 原薬(API)の世界市場:タイプ別、力価別、合成タイプ別、薬剤タイプ別、治療用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年10月15日

発行: MarketsandMarkets

ページ情報: 英文 578 Pages

納期: 即納可能

|

概要

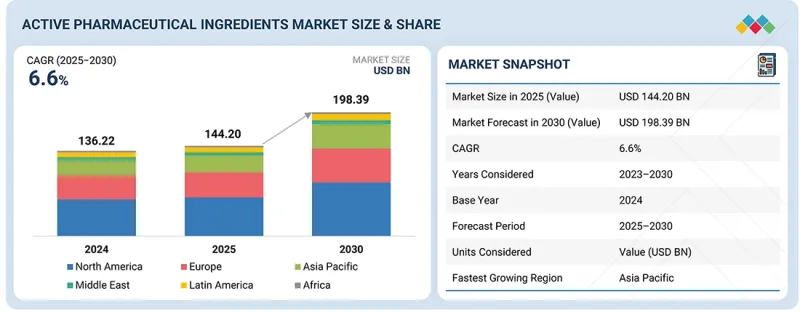

世界の原薬(API)の市場規模は、2025年の推定1,442億米ドルから2030年には1,983億9,000万米ドルに達すると予測され、2025年から2030年までのCAGRは6.6%です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、力価別、合成タイプ別、薬剤タイプ別、治療用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

原薬市場の拡大は、がん・希少疾患と糖尿病製品のパイプラインの拡大が主な要因となっています。過去数年間で、2型糖尿病と肥満の治療は、セマグルチド、ティルゼパチド、リラグルチド、デュラグルチドに代表されるペプチドベースの新薬クラスによって再構築されました。これらの治療法は患者の転帰を変え、APIサプライチェーン全体に大きなチャンスをもたらしています。

エンドユーザー別では、市場は製薬&バイオテクノロジー産業、受託研究機関(CRO)、受託製造機関(CMO)、その他のエンドユーザーに分類されます。製薬・バイオ産業は、医薬品開発・製造に不可欠な原薬(API)の主要エンドユーザーを占めています。製薬業界では過去5年間、特に高力価医薬品やADCなどの医薬品・生物製剤の開発・製造において、CMOへの製造アウトソーシングが増加しています。しかし、製薬会社やバイオテクノロジー企業は、高価値のブロックバスター医薬品や生物製剤の自社製造を維持することで、依然としてエンドユーザー・セグメントを支配しています。さらに、革新的な治療法に対する需要の高まりが研究開発への継続的な投資を促し、各社は新薬や先進的な製剤の創製を優先しています。これらの動向は、製薬・バイオテクノロジーエンドユーザーセグメントの成長をさらに強化すると予想されます。

タイプ別に見ると、世界の原薬(API)市場は革新的APIとジェネリックAPIに分けられます。2024年には、新薬・先端薬の規制承認件数の増加に牽引され、革新的APIが市場を席巻しており、これは予測期間中も成長を支え続けると予想されます。例えば、米国FDAは2024年に50以上の新薬(NME)を承認しましたが、これは新薬開発のペースが上がっていることを反映しています。革新的原薬は特許で保護されているため、一般的にジェネリック原薬よりも価格が高く、市場シェアの拡大に寄与しています。このセグメントの成長は、製薬企業やバイオテクノロジー企業が、がん、希少疾患、生物学的製剤など、複雑でアンメット・メディカル・ニーズの高い新規治療薬の開発に注力していることによって、さらに強化されています。さらに、研究開発への投資、高度な製造能力、規制上の優遇措置により、革新的な原薬の導入が引き続き促進されています。これらの要因により、革新的なAPIは高い価値と旺盛な需要を反映し、世界のAPI市場の主要セグメントとして位置づけられています。

市場は地域別に北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに区分されます。アジア太平洋は予測期間中に最も高いCAGRで成長すると予測されています。市場成長に寄与する主な要因としては、高価値治療薬の採用と需要の増加が、世界的・地域的企業による製造拡大を促進していることが挙げられます。加えて、合成療法や生物学的療法に注力する同地域のCDMOの拡大も、原薬の需要促進に寄与しています。中国、日本、韓国、インド、オーストラリアでは、革新的なジェネリック医薬品の採用が拡大しており、アジア太平洋における製造施設の拡大がこれを後押ししています。さらに、コスト効率の高い製造、ジェネリック医薬品とバイオシミラーの生産拡大、輸入への依存を減らすための現地での原薬製造に対する政府の強力な支援が組み合わさっています。インドと中国は、大規模な生産能力、熟練した労働力、有利な規制イニシアチブにより、世界のハブとして台頭しており、この地域の原薬市場の成長を支えています。

当レポートでは、世界の原薬(API)市場について調査し、タイプ別、力価別、合成タイプ別、薬剤タイプ別、治療用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- サプライチェーン分析

- バリューチェーン分析

- エコシステム分析

- 主要な会議とイベント

- 規制分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- マクロ経済指標

- 特許分析

- アンメットニーズと空白

- 貿易データ

- 投資と資金調達のシナリオ

- 主要APIサプライヤーの製造拠点と生産能力拡大

- AI/生成AIが原薬(API)市場に与える影響

- 米国関税が原薬(API)市場に与える影響

第6章 原薬(API)市場、タイプ別

- イントロダクション

- 原薬(API)(タイプ別、自社および販売元)

- 革新的API

- 汎用API

第7章 原薬(API)市場、力価別

- イントロダクション

- 原薬(API)(力価別、自社および販売元)

- 従来API

- 強力API

第8章 原薬(API)市場、合成タイプ別

- イントロダクション

- 原薬(API)(合成タイプ別、自社および販売元別)

- 合成API

- バイオテクノロジーAPI

第9章 原薬(API)市場、薬剤タイプ別

- イントロダクション

- 原薬(API)(薬剤タイプ別、自社および販売元)

- 処方薬

- 市販薬

第10章 原薬(API)市場、治療用途別

- イントロダクション

- 原薬(API)(治療用途別、自社および販売元)

- 伝染病

- 腫瘍学

- 糖尿病

- 心血管疾患

- 呼吸器疾患

- 疼痛管理

- その他

第11章 原薬(API)市場、エンドユーザー別

- イントロダクション

- 原薬(API)(エンドユーザー別、自社および販売元)

- 製薬・バイオテクノロジー業界

- CRO

- CMO

- その他

第12章 原薬(API)市場、地域別

- イントロダクション

- 原薬(API)市場(地域別、自社および販売元)

- 北米

- 北米のマクロ経済分析

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済分析

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ハンガリー

- その他

- アジア太平洋

- アジア太平洋のマクロ経済分析

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

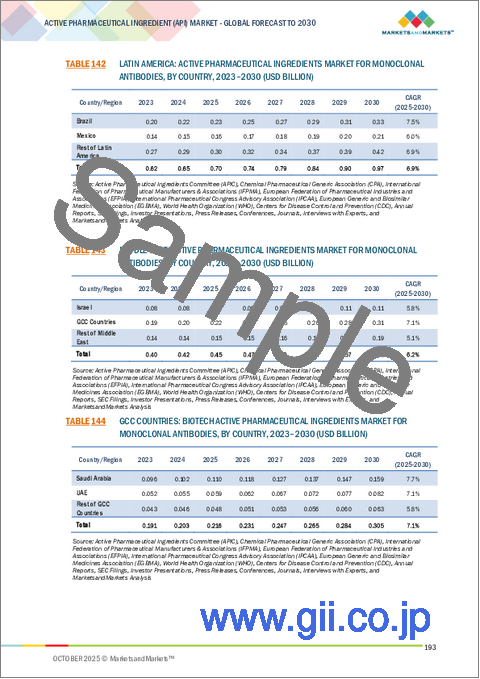

- ラテンアメリカ

- ラテンアメリカ:マクロ経済分析

- ブラジル

- メキシコ

- その他

- 中東

- 中東のマクロ経済分析

- イスラエル

- GCC諸国

- その他

- アフリカ

- 医薬品の需要増加が市場を牽引

- アフリカのマクロ経済見通し

第13章 競合情勢

- イントロダクション

- 原薬(API)市場における主要企業が採用している戦略の概要

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- PFIZER INC.

- DIVI'S LABORATORIES LIMITED

- ASYMCHEM INC.

- CIPLA

- EVONIK

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- SANDOZ GROUP AG

- SK INC.

- MERCK KGAA

- DR. REDDY'S LABORATORIES LTD.

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- AUROBINDO PHARMA LIMITED

- HIKMA PHARMACEUTICALS PLC

- BASF

- ALEMBIC PHARMACEUTICALS LIMITED

- SIEGFRIED HOLDING AG

- EUROAPI

- BACHEM

- ZHEJIANG HUAHAI PHARMACEUTICAL CO., LTD.

- ZHEJIANG HISUN PHARMACEUTICAL CO., LTD.

- その他の企業

- POLYPEPTIDE GROUP

- GRANULES INDIA

- CORDEN PHARMA

- RECIPHARM

- ABURAIHAN PHARMACEUTICAL COMPANY

- CURIA GLOBAL, INC.

- CAMBREX CORPORATION

- API PHARMA TECH

- SREEPATHI PHARMACEUTICALS LIMITED

- SHILPA MEDICARE LIMITED

- NANJING JIANYOU BIOCHEMICAL PHARMACEUTICAL CO., LTD.

- HOVIONE

- CHEMCON GMBH

- PHARCO PHARMACEUTICALS

- SAMBI PHARMA PVT. LTD.