|

|

市場調査レポート

商品コード

1829979

熱伝導流体の世界市場:製品タイプ別、温度別、最終用途産業別、地域別 - 2030年までの予測Heat Transfer Fluids Market by Product Type, Temperature, Application, End-Use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 熱伝導流体の世界市場:製品タイプ別、温度別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月18日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

概要

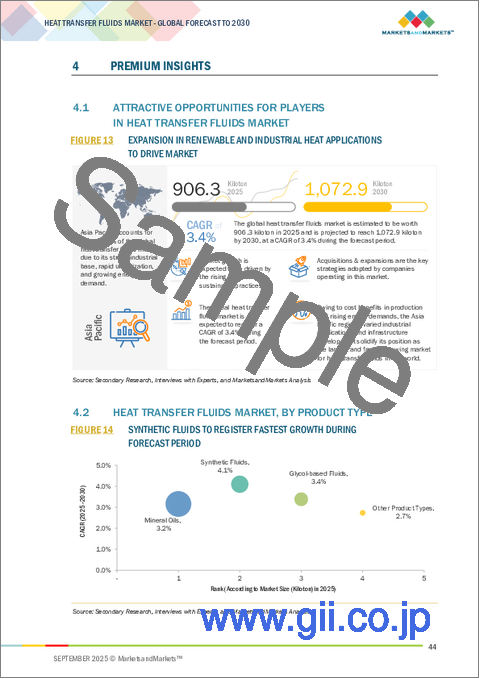

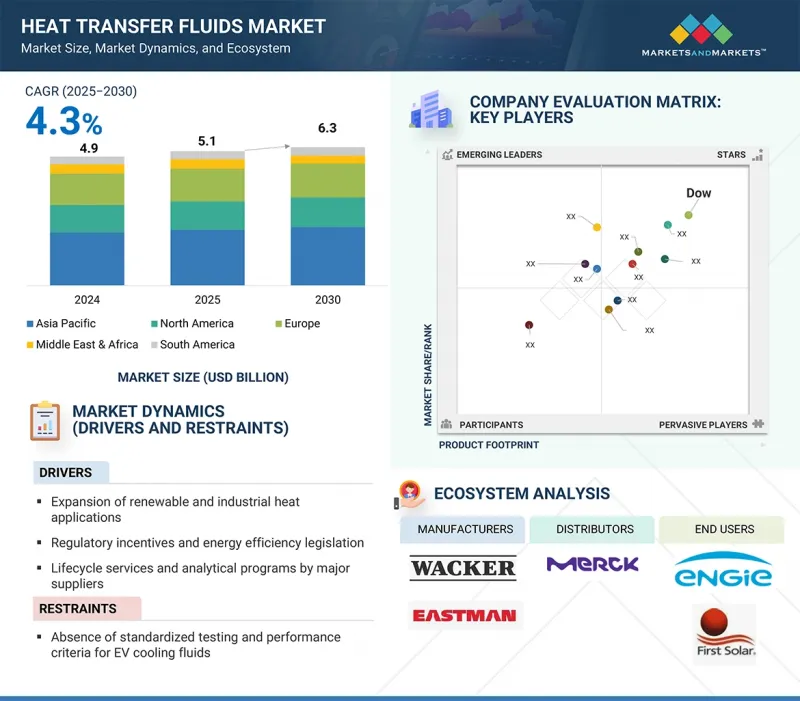

熱伝導流体の市場規模は、2025年の51億米ドルから2030年には63億米ドルに成長し、予測期間中のCAGRは4.3%を記録すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2024年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(10億米ドル/100万米ドル)および数量(キロトン) |

| セグメント | 製品タイプ別、温度別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

熱伝導流体市場の成長は、急速な工業化、エネルギー効率化ニーズの高まり、主要な最終用途産業の拡大など、いくつかの重要な要因によって牽引されています。特に新興国では、工業プロセスの高度化と普及に伴い、効果的な熱管理ソリューションへの要求が極めて重要になっています。化学、石油化学、自動車、飲食品、医薬品、HVACなどの産業は、最適な運転温度を維持し、効率的なプロセスを確保するため、熱媒体に大きく依存しています。熱媒体はエネルギー消費を削減し、熱システム全体の性能を向上させるために不可欠であるため、省エネルギーと効率性を重視する傾向が強まっていることが、市場をさらに後押ししています。

さらに、太陽光発電や風力発電のような再生可能エネルギー源の採用は、エネルギー貯蔵と伝達のための高度な熱伝導流体を要求しています。より優れた熱安定性、より低いメンテナンス、より高い安全性を提供する熱伝導流体の配合における技術革新も、市場の拡大を支えています。さらに、厳しい環境規制と持続可能な産業慣行へのシフトが、高性能で環境に優しい熱媒体の使用を促進し、市場をさらに拡大しています。こうした複合的な要因が、さまざまな分野で強い需要を生み出し、市場全体の成長に拍車をかけています。

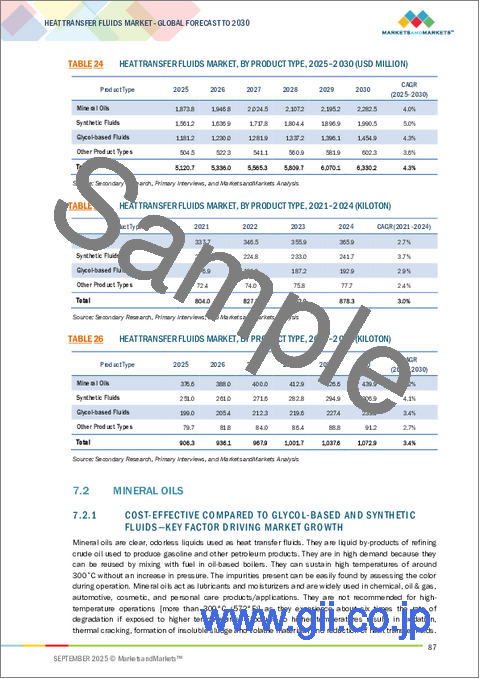

合成流体は、その優れた性能特徴により、要求の厳しい産業用途に非常に適しているため、熱媒体市場において最も急成長し、2番目に大きなセグメントを占めています。鉱物油やグリコールベースの流体とは異なり、合成流体は卓越した熱安定性を持ち、高温でも低温でも分解することなく効率的な運転を可能にします。この品質により、化学処理、製薬、高温製造など、熱的ニーズが厳しい産業に最適です。さらに、合成流体は熱伝達効率に優れ、揮発性が低いため、システムの安全性と耐久性が向上します。また、合成流体は酸化やファウリングに対する耐性が高いため、メンテナンスコストを削減し、伝熱システムの寿命を延ばすことができます。さらに、合成流体はより厳しい環境・安全基準に適合していることが多いため、規制の厳しい地域では好ましい選択肢となります。合成油は鉱物油よりもコストが高い傾向にあるが、長期的な性能の優位性と運転効率は投資を正当化するものであり、有力な市場シェアを確保しています。

中温用熱伝導流体は、性能、コスト、汎用性の最適なバランスを提供し、幅広い産業業務に適しているため、熱伝導流体業界で2番目に大きな市場シェアを占めています。通常150℃から400℃の間で機能するこれらの流体は、化学加工、プラスチック、石油・ガス、飲食品製造など、安定した加熱と冷却が必要ですが、高温流体や極低温流体のような極端な耐性は要求されない産業で広く使用されています。急速に劣化することなく安定した熱性能を発揮できるため、高温合成流体と比べてコスト効率が高く、冷凍やコールドチェーン用途以外では低温流体よりも幅広い適用が可能です。ポリマーや樹脂の生産、精製、一般的な製造などの分野では、中温HTFは正確な温度制御を保証し、エネルギー消費を削減し、プロセス効率を向上させるため、必要不可欠な存在となっています。さらに、新興国における工業化の進展と、エネルギー効率が高く安全な熱管理ソリューションの必要性が、これらの流体の需要を押し上げています。連続プロセスでもバッチプロセスでも汎用性があり、メンテナンスや交換サイクルが容易なことから、中温用流体は世界の熱媒体市場で2番目に多く使用されています。

化学、ポリマー、医薬品、加工食品、金属などの需要増加を背景に、世界の製造業が急速に拡大しているため、産業加工は熱伝導流体(HTF)市場で最も急成長している分野です。これらの産業では、蒸留、重合、晶析、精製、リアクター加熱などのプロセスで正確な熱管理が必要であり、HTFは効率、安全性、製品の一貫性を保証します。工業処理の開発は、アジア太平洋、中東、ラテンアメリカの新興経済諸国において特に力強い伸びを示しており、そこでは急速な工業化、都市化、インフラ整備が、化学プラント、製油所、製造施設への大規模な投資を後押ししています。さらに、より厳しいエネルギー効率規制と持続可能性の目標が、従来の加熱方法から、エネルギー損失を減らし、機器の寿命を延ばし、運転の信頼性を高める先進的なHTFへの切り替えを産業界に促しています。環境にやさしく、より長持ちするHTFの開発など、継続的な技術進歩が産業現場での採用をさらに促進しています。HVACや自動車のような他の用途に比べ、産業用加工では大量のHTFが使用されます。このように、最終用途産業の拡大、規制の後押し、技術の向上が組み合わさることで、産業用加工は熱媒体の用途分野として世界的に急成長しています。

HVAC業界は、家庭、企業、産業におけるエネルギー効率の高い冷暖房ソリューションに対する世界的な需要の高まりにより、熱媒体(HTF)の最終用途分野として急速に成長しています。急速な都市化、人口増加、生活水準の向上により、特にアジア太平洋、中東、ラテンアメリカの発展途上地域では、空調、冷蔵、暖房システムのニーズが高まっています。一方、北米と欧州の成熟市場では、より厳しいエネルギー効率と環境基準を満たすためにHVACシステムのアップグレードが進んでおり、これがエネルギー損失を抑えながらより優れた熱性能を提供する先進的なHTFの採用を後押ししています。さらに、コールドチェーンロジスティクス、データセンター、グリーンビルディングの成長により、低温から中温の範囲で確実に作動するグリコール系および合成系HTFの需要が高まっています。持続可能性への注目が高まる中、メーカー各社はHVAC用途に特化して設計された環境に優しく無害なHTFも発売しており、その採用はさらに加速しています。他の分野と比べ、HVACは、システムのアップグレードの進行、気候変動、冷房への依存度の増加、エネルギー効率の高い建築技術を推進する政策などにより、高い成長の可能性を秘めています。これらの要因から、HVACは熱媒体市場で最も急成長している最終用途産業となっています。

当レポートでは、世界の熱伝導流体市場について調査し、製品タイプ別、温度別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 生成AIの影響

第6章 業界動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 価格分析

- 投資情勢と資金調達シナリオ

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済見通し

- ケーススタディ分析

- 2025年の米国関税の影響- 熱伝導流体市場

第7章 熱伝導流体市場(製品タイプ別)

- イントロダクション

- ミネラルオイル

- 合成流体

- グリコールベースの流体

- その他

第8章 熱伝導流体市場(温度別)

- イントロダクション

- 低温

- 中温

- 高温

- 超高温

第9章 熱伝導流体市場(最終用途産業別)

- イントロダクション

- 化学・石油化学

- 石油・ガス

- 自動車

- 再生可能エネルギー

- 医薬品

- 食品・飲料

- 空調設備

- その他の最終用途産業

第10章 熱伝導流体市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- アルゼンチン

- ブラジル

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- DOW

- EASTMAN CHEMICAL COMPANY

- EXXON MOBIL CORPORATION

- CHEVRON CORPORATION

- HUNTSMAN CORPORATION

- SHELL PLC

- LANXESS

- CLARIANT

- WACKER CHEMIE AG

- INDIAN OIL CORPORATION LTD.

- SCHULTZ CANADA CHEMICALS LTD.

- その他の企業

- PARATHERM

- ARKEMA

- BASF SE

- DALIAN RICHFORTUNE CHEMICALS CO., LTD.

- BRITISH PETROLEUM

- DUPONT TATE & LYLE BIOPRODUCTS COMPANY LLC

- DYNALENE

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- GLOBAL HEAT TRANSFER LTD.

- ISEL

- PARAS LUBRICANTS LTD.

- PETRO-CANADA LUBRICANTS, INC.

- PHILLIPS 66 COMPANY

- RADCO INDUSTRIES, INC.

- SCHAEFFER MANUFACTURING CO.