|

|

市場調査レポート

商品コード

1931745

マイクロ流体の世界市場:製品別、用途別、エンドユーザー別、地域別 - 2030年までの予測Microfluidics Market by Product (Chip, Sensor, Valve, Pump, Needle), Material (Silicon, Polymer), Application, End User - Global forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| マイクロ流体の世界市場:製品別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2026年01月30日

発行: MarketsandMarkets

ページ情報: 英文 326 Pages

納期: 即納可能

|

概要

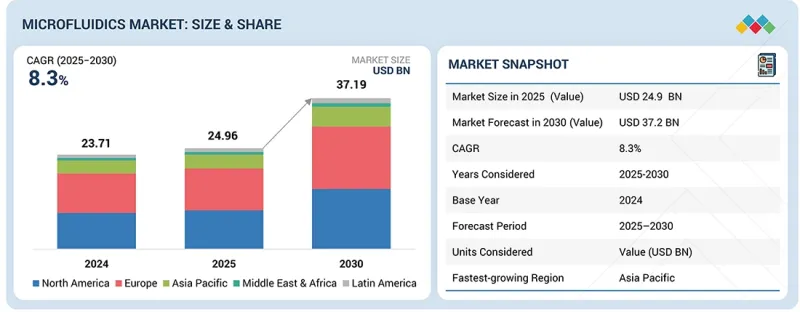

マイクロ流体の市場規模は、2025年の249億6,000万米ドルから2030年までに372億米ドルに達すると予測されており、予測期間中はCAGR8.3%で成長する見込みです。マイクロ流体市場は、いくつかの重要な要因により拡大しています。その重要な要因の一つが、ポイントオブケア診断(POC診断)に対する需要の高まりです。がんや糖尿病などの慢性疾患の増加に伴い、迅速かつ正確な診断の必要性が高まっており、これが医療分野におけるマイクロ流体技術の応用を推進しています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント | 製品別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

さらに、ドラッグデリバリー、臓器オンチップ技術、個別化医療における革新により、マイクロ流体デバイスの利用が増加しています。加えて、プロテオミクスおよびゲノミクス関連調査の増加が市場を牽引しています。

マイクロ流体市場は、ポリマーの低コスト性、製造の容易さ、適応性により牽引されています。マイクロ流体デバイスの製造には、ポリジメチルシロキサン(PDMS)、ポリメチルメタクリレート(PMMA)、環状オレフィンコポリマー(COC)などのポリマーが頻繁に必要とされます。これらのポリマーは、マイクロ流体チャネルや構造体の作製に有用です。さらに、シリコンやガラスなどの従来材料と比較して、ポリマーは成形が容易であり、製造コストの削減も可能にします。ポリマーの生体適合性は、薬剤送達、ラボオンチップ、診断など、様々な医療用途に有用です。このような利点により、ポリマーはマイクロ流体市場において最大のシェアを占めています。

マイクロ流体産業における病院・診断センターの成長を推進する様々な重要な要因があります。その一つが、迅速な現場検査により患者の治療成果を向上させる「ポイント・オブ・ケア診断」の需要増加でございます。マイクロ流体技術は、より迅速かつ正確な結果を提供するため、この良好な結果に大きく貢献しています。さらに、COVID-19のような感染症の増加により、臨床現場における効果的な診断の必要性が高まっています。これらの機器はコスト削減、検査方法の迅速化、診断の精度と正確性の向上を実現します。

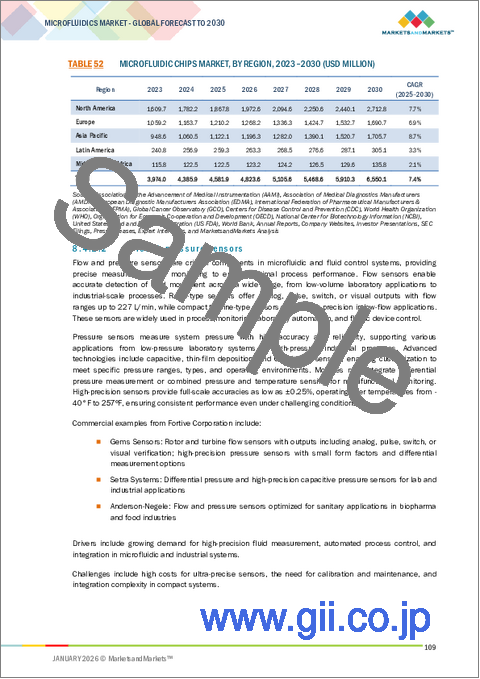

2024年から2029年の予測期間において、アジア太平洋地域(APAC)で最も高いCAGRが記録されました。アジア太平洋地域には、インド、中国、日本、オーストラリア、韓国、およびその他のアジア太平洋地域(RoAPAC)が含まれます。特に中国、インド、日本では新技術への需要が高まっています。政府は学術機関における研究開発活動の促進に力を注いでおり、日本政府は2021年から2025年までの第6次科学技術基本計画に向けて642億6,000万米ドルを配分しました。慢性疾患や感染症の発生率上昇に加え、早期診断や予防医療への関心の高まりにより、マイクロ流体デバイスの利用が飛躍的に拡大しています。同地域で急成長している製薬・ライフサイエンス分野も研究開発を推進しており、マイクロ流体技術の需要増加につながっています。

この市場における主要企業は、Abbott laboratories(米国)、Agilent Technologies, Inc.(米国)、Aignep S.P.A(イタリア)、biomerieux(フランス)、BD(米国)、Bio-Rad laboratories, Inc(米国)、Danaher Corporation(米国)、Illumina Inc.(米国)、Parker Hannifin Corporation(米国)、Thermo Fisher Scientific Inc.(米国)、SMC Corporation(日本)、Idex Corporation(米国)、Fortive Corporation(米国)、Perkinelmer, Inc.(米国)、F.Hoffmann-LA Roche Ltd(スイス)、Standard Biotools Inc.(米国)、Quidelortho Corporation(米国)、Hologic Inc.(米国)、Dolomite Microfluidics(英国)、Elveflow(フランス)。

調査範囲

当レポートは、エンドユーザー、製品、用途、地域別のセグメンテーションを網羅しています。また、マイクロ流体市場の成長軌道を左右する主要な促進要因、抑制要因、機会、課題についても取り上げています。主要プレイヤーと競合情勢を焦点に、市場の可能性と課題に関する詳細な分析を利害関係者に提供します。さらに、マイクロ市場は、世界のマイクロ流体セクターへの全体的な影響、成長パターン、潜在的可能性に基づいて分析されます。本分析では、5つの主要地域に焦点を当て、市場セグメンテーション収益の増加を予測しています。

当レポート購入の主な利点:

本調査の目的は、マイクロ流体市場における新規参入企業および既存企業双方が、詳細かつ専門的な情報を得ることで投資の持続可能性を評価するお手伝いをすることです。重要な意思決定を支援するデータセットを提供します。当レポートが徹底的なリスク評価を促進し、投資判断の方向性を示す可能性は、その主要な利点の一つです。エンドユーザーおよび地理的領域に基づく市場セグメンテーションを本調査で提供し、正確な分析と洞察を提供します。また、重要な動向、障壁、機会、促進要因を提示し、利害関係者が長期的な成長に資する戦略的決定を行うために必要な情報を提供します。

当レポートは以下のポイントに関する洞察を提供します:

マイクロ流体市場成長に影響を与える主要な促進要因、制約、機会、課題の分析 - ・革新的技術と慢性疾患の有病率増加・機器コストの上昇と厳格な規制・診断センターの増加

製品開発/イノベーション:マイクロ流体産業における技術概要、研究開発プロジェクト、革新的製品・サービスの導入状況。

市場開発 - 収益性の高い市場に関する詳細情報 - 本調査では、様々な地理的地域におけるマイクロ流体事業の動向を分析しています。

市場の多様化:マイクロ流体市場における革新的な製品、未開拓地域、最近の動向、および支出に関する深い理解。

競合評価:市場シェア、提供サービスおよび製品、ならびに、Danaher Corporation(米国)、Illumina Inc.(米国)、biomerieux(フランス)、Thermo Fisher Scientific Inc.(米国)、Abbott laboratories(米国)などの有力企業による主要戦略の詳細な分析。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- 市場力学

- 促進要因

- マイクロ流体技術の導入を促進するeヘルスとデジタル診断

- 抑制要因

- 機会

- 課題

- アンメットニーズ

- 相互接続された市場と分野横断的な機会

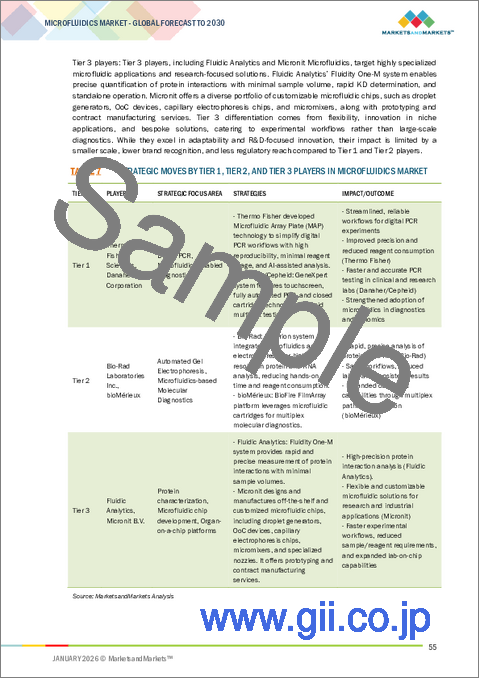

- ティア1/2/3プレイヤーの戦略的動き

第5章 技術、特許、AI導入による戦略的破壊

- 主要技術

- 補完的技術

- 特許分析

- 将来の応用

- AI/生成AIがマイクロ流体市場に与える影響

- 成功事例と実世界への応用

- 規制状況

第6章 顧客情勢と購買行動

- 購入者の利害関係者と購入評価基準

- 意思決定プロセス

- 採用障壁と内部課題

- エンドユーザーのアンメットニーズ

第7章 業界動向

- ポーターのファイブフォース分析

- マクロ経済指標

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易データ分析

- 2026年~2027年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税がマイクロ流体市場に与える影響

第8章 マイクロ流体市場(製品別)

- マイクロ流体ベースのデバイス

- その他のデバイス

- マイクロ流体コンポーネント

第9章 マイクロ流体市場(用途別)

- 体外診断(IVD)

- 治療薬

- 医薬品およびライフサイエンス調査

第10章 マイクロ流体市場(エンドユーザー別)

- 病院と診断センター

- 製薬・バイオテクノロジー企業

- 学術研究機関

第11章 マイクロ流体市場(地域別)

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- GCC諸国

- その他

第12章 競合情勢

- 主要参入企業の戦略/強み

- マイクロ流体市場における主要企業が採用している戦略の概要

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 主要市場参入企業のランキング

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較分析

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- DANAHER CORPORATION

- ILLUMINA, INC.

- BIOMERIEUX

- THERMO FISHER SCIENTIFIC INC.

- ABBOTT LABORATORIES

- PARKER HANNIFIN CORP

- SMC CORPORATION

- IDEX CORPORATION

- FORTIVE

- REVVITY, INC.

- AGILENT TECHNOLOGIES, INC.

- BIO-RAD LABORATORIES, INC.

- BECTON, DICKINSON AND COMPANY

- F. HOFFMANN-LA ROCHE LTD.

- STANDARD BIOTOOLS

- QUIDELORTHO CORPORATION

- AIGNEP S.P.A.

- DOLOMITE MICROFLUIDICS

- ELVEFLOW

- その他の企業

- NANOSTRING TECHNOLOGIES

- INNOVATIVE BIOCHIPS, LLC

- FLUIDIC ANALYTICS

- HORIBA

- MICRONIT B.V.

- EMULATE, INC.

- SPHERE BIO

- ZEON CORPORATION

- QIAGEN N.V.